How Employers Can Recession-Proof Their Health Benefits

If you’ve been wondering if the U.S. is in a recession, or you think we’ll be there soon, you’re not alone. Pinpointing exactly when a downturn hits...

Providing competitive health benefits to employees seems to get harder with each passing year. In 2021, average annual employer-sponsored healthcare premiums were $7,739 for a single employee and a whopping $22,221 for family coverage. That’s a 4 percent increase from 2020. Zoom out further, and you’ll notice a 22 percent increase for family coverage over the last five years and a painful 47 percent increase in the last decade alone. Since the average employer pays 78 percent of that premium, rising healthcare costs are just as challenging for small and medium-sized businesses as they are for workers.

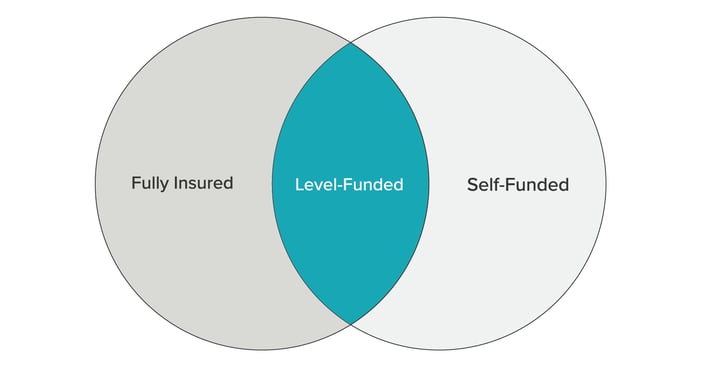

Adding to the complexity of providing health benefits these days, the right plan for your company may change over time. What worked for you as a startup may not be the most cost-effective option a few years down the line. Yet, offering competitive benefits is critical for attracting and retaining top talent — and ensuring workers perform at their best each day. If you’re a small to mid-size employer, with 15 to 125 workers, offering fully insured or self-insured plans may not be the best option for your bottom line. Luckily, a third offering bridges the gap between these two plans: level-funded health plans. Here’s where level-funded plans fit into the employer-sponsored healthcare landscape, why this option tends to be a good fit for mid-size employers, and how to find the right one for your company.

There are three main ways to fund employer-sponsored health plans. Choosing the right one for your company could be the difference between maximizing your investment in your people — and leaving a lot of money on the table.

Fully insured health plans are the most hands-off option for companies, which means they’re often the best choice for small businesses and startups with a workforce under 15. With these plans, you and your employees pay a monthly premium for coverage, and the insurer handles all claims. Employers rely completely on the insurer to fund claims, and premium costs can be high, reflecting the fact that businesses transfer all risk to the carrier. As healthcare costs rise, you have little ability to mitigate them, so you can expect these premiums to increase each year. In a single year, you may see an increase of 4 percent, like companies saw last year. Over a decade, you may see a 47 percent rise, like companies have seen since 2011.

The good news is that these costs are generally predictable. You don’t have to worry about paying out $2,000 in claims one month and $20,000 the next. And you won’t need to invest in a ton of administrative resources to keep things running because the insurer handles it all.

Self-insured health plans are the opposite of fully insured plans. Instead of relying on an insurance company to pay out claims, companies pay claims as they arise, often using a trust the organization sets up for this purpose.

Since there are limited upfront premiums, self-insured plans are ideal for large companies who have the capital to properly fund their trust. Larger, established businesses can also utilize claims data from their sizeable employee data pool, allowing them to properly predict claims costs and avoid any surprises.

Additionally, well-funded, self-insured plans are customizable, fitting workers’ needs more precisely, which can save money and offer more competitive benefits in the long run. It is important, however, for these sizeable businesses to budget for the administrative costs associated with this plan.

Not surprisingly, out of the 64 percent of covered workers who are enrolled in self-funded plans, 82 percent are employees who work for large companies, while only 21 percent of employees come from small companies.

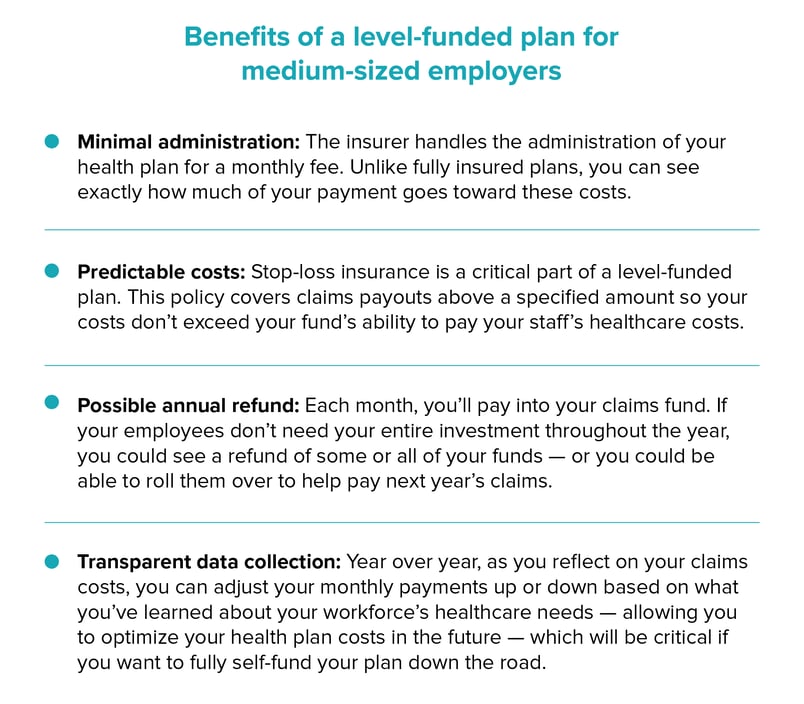

Level-funded plans are a hybrid of fully insured and self-funded plans. You pay a level monthly cost to an insurer that covers administration costs, claims prepayment, and stop-loss coverage (insurance that protects you against large, unpredictable claims). The insurer carefully tracks all claims payouts. At the end of the year, if you don’t use all the funds in your claims prepayment account, you may be able to recover a portion of it.

Essentially, you get the best of both worlds. You have predictable monthly costs with the opportunity for savings each year. And the insurer handles most of the time-consuming, financially burdensome administrative tasks.

Traditionally, employers had two choices for funding their workers’ health plans: fully insured and self-insured. But lately, level-funded plans have been gaining in popularity. According to the Kaiser Family Foundation, 42 percent of companies with three to 199 employees used level-funded plans in 2021, up from 13 percent in 2020. And these plans can work well for larger companies too.

As your company grows, a level-funded plan allows you to dip a toe into more actively managing your staff’s healthcare needs while continuing to mitigate the risks of taking on claims payments yourself.

As level-funded plans grow in popularity, more of these plans are becoming available. Finding the right fit for your business can be challenging, but here are a few things to look for.

Network curation

Network curationOne of the best ways to keep claims costs low — and keep an annual refund in sight — is for your employees to choose in-network healthcare providers that deliver excellent outcomes. Make sure any level-funded plans on your shortlist have carefully curated provider lists to ensure quality, cost-effective care.

You may consider a value-based option like a high-performance network (HPN), which balances healthcare quality and efficiency by providing access to a smaller network of lower-cost providers.

According to the American Academy of Actuaries, the “success of HPNs should benefit all the key participating stakeholders—patients, network providers, and insurers/plan sponsors—by decreasing cost and increasing quality of care.” Markers of a successful HPN include high proportions of engaged members, high quality medical care, successful clinical outcomes, appropriate use of health care services, competitive costs and, naturally, a patient understanding of expected out-of-pocket costs.

As the American Academy of Actuaries notes, when it comes to network curation/HPNs, it is essential that insurers, providers, employer groups, and members remain “engaged and focused on the same goals of providing the right care at the right place at the right time at the right price and risk.”

Plenty of plan options

Plenty of plan optionsOptions are also key when offering a level-funded plan. Without plan options that match your employees’ needs, you could have trouble attracting or retaining top talent. And the talent you keep won’t be at their best if they delay care because of a high deductible. (The pandemic has only further exasperated Americans’ habit of delaying medical care, and the CDC has officially correlated healthcare avoidance with an increase in “morbidity and mortality” due to “chronic and acute health conditions.”) A level-funded plan with multiple cost-sharing options, however, can empower your employees to seek regular, quality care when they need it. In short, don’t cut corners when offering plan options. Saving money on employer health insurance costs may boost your bottom line in the immediate future, but offering less-than-competitive benefits could hurt your company in the long run.

Frequent data reports

Frequent data reportsWith a level-funded plan, a healthy year for your employees means a healthy refund of your claims fund. Knowing where employees are spending healthcare dollars can also help you design and implement wellness programs for your staff. Maybe your workforce would benefit from in-office health screenings or nutritional education. Getting monthly reports on the kinds of claims your fund is paying out can help you keep a pulse on overall employee health so you can encourage better habits and offer health resources tailor-made for your team.

As the cost of healthcare keeps rising, small and mid-size employers need to be nimble, offering competitive benefits at a reasonable cost. Level-funded plans can meet you where you are — in the middle — with a balance of low upfront costs, minimal claims risk, and a possible annual refund. If your company has between 15 and 125 employees, a level-funded plan may be the perfect fit.

If you are interested in learning more, contact hchtruechoice@healthcarehighways.com.

If you’ve been wondering if the U.S. is in a recession, or you think we’ll be there soon, you’re not alone. Pinpointing exactly when a downturn hits...

2 min read

In January 2010, two well-known Texas-based health systems approached Michael G. Wilson and his experienced team with a critical need: building...

“Value-based care” (VBC) and “fee-for-service” (FFS) are key terms for self-insured employers seeking financial control over annually increasing...